The Partnership sends updates for the most important economic indicators each month. If you would like to opt-in to receive these updates, please click here.

Estimated Reading Time: 3 minutes

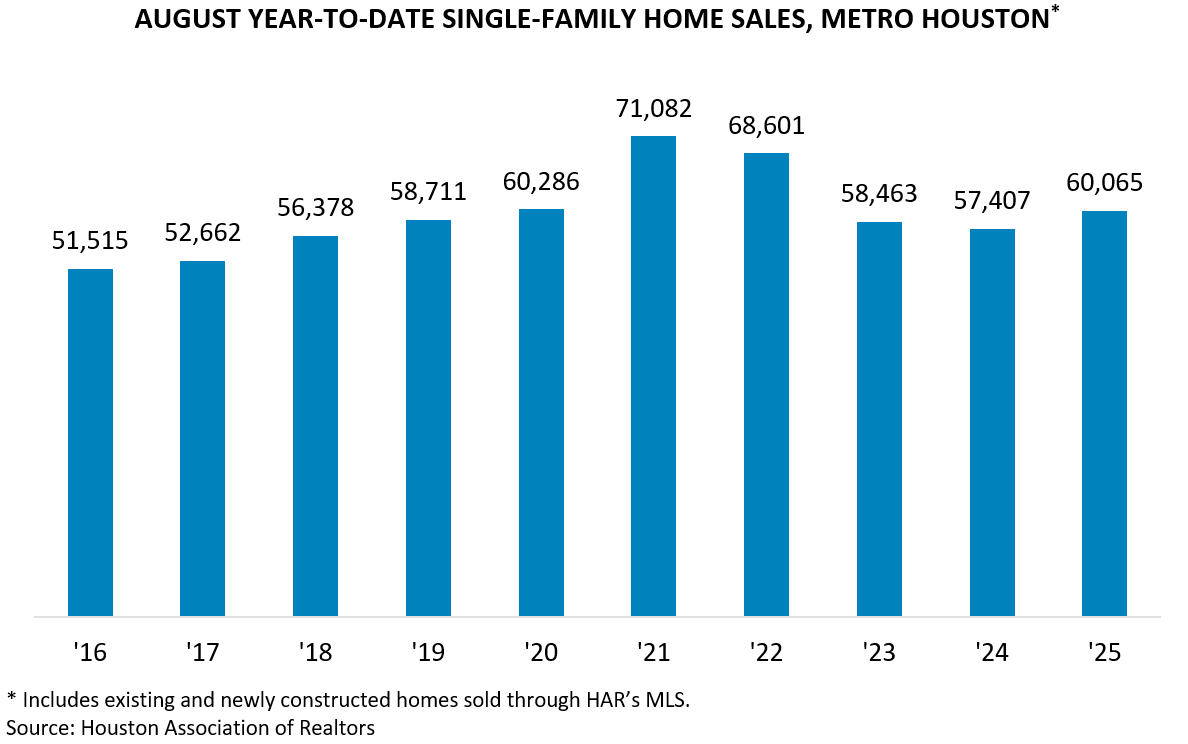

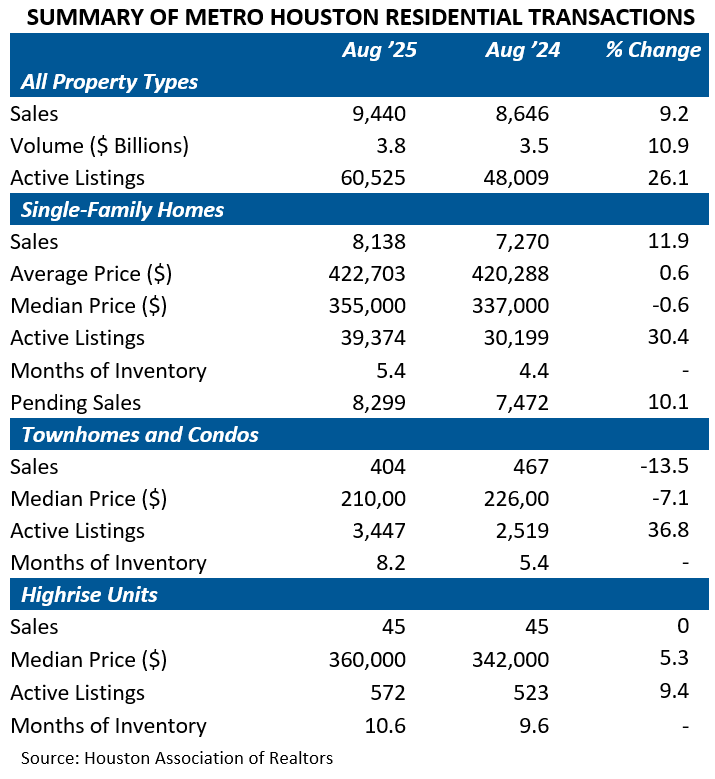

Brokers closed on 60,065 single-family homes year-to-date through August ‘25, according to the Houston Association of Realtors (HAR). This represents a 4.6 percent increase compared to the same period in ’24. Inventories of homes on the market dropped for the first time in ‘25, but remained near July’s all-time high. Mortgage rates continued to decline to their lowest level since October ’24, while prices show signs of easing.

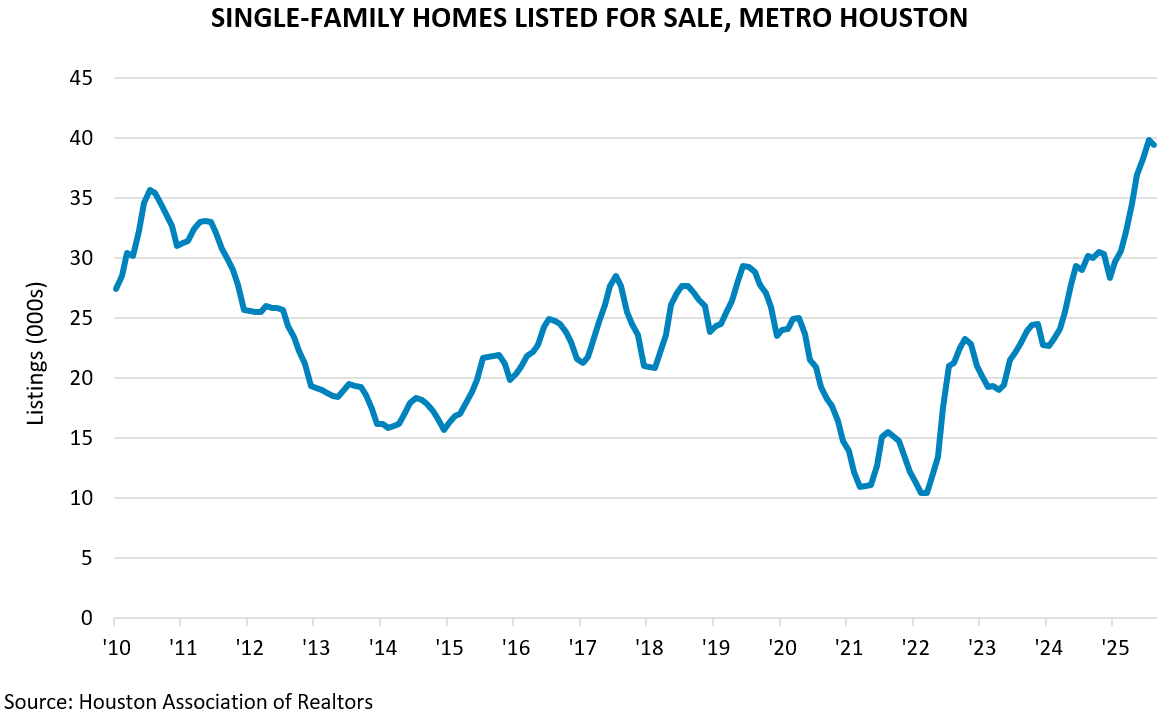

The number of single-family homes listed for sale through HAR was 39,374 in August ’25, a 30.4 percent increase above August ’24. However, inventories dropped on a month-over-month basis for the first time this year from the all-time high of 39,847 homes recorded in July. If single-family homes were to continue selling at the current rate, it would take 5.4 months to sell the available inventory of homes on the market. That’s up from 4.4 months of inventory in August ’24.

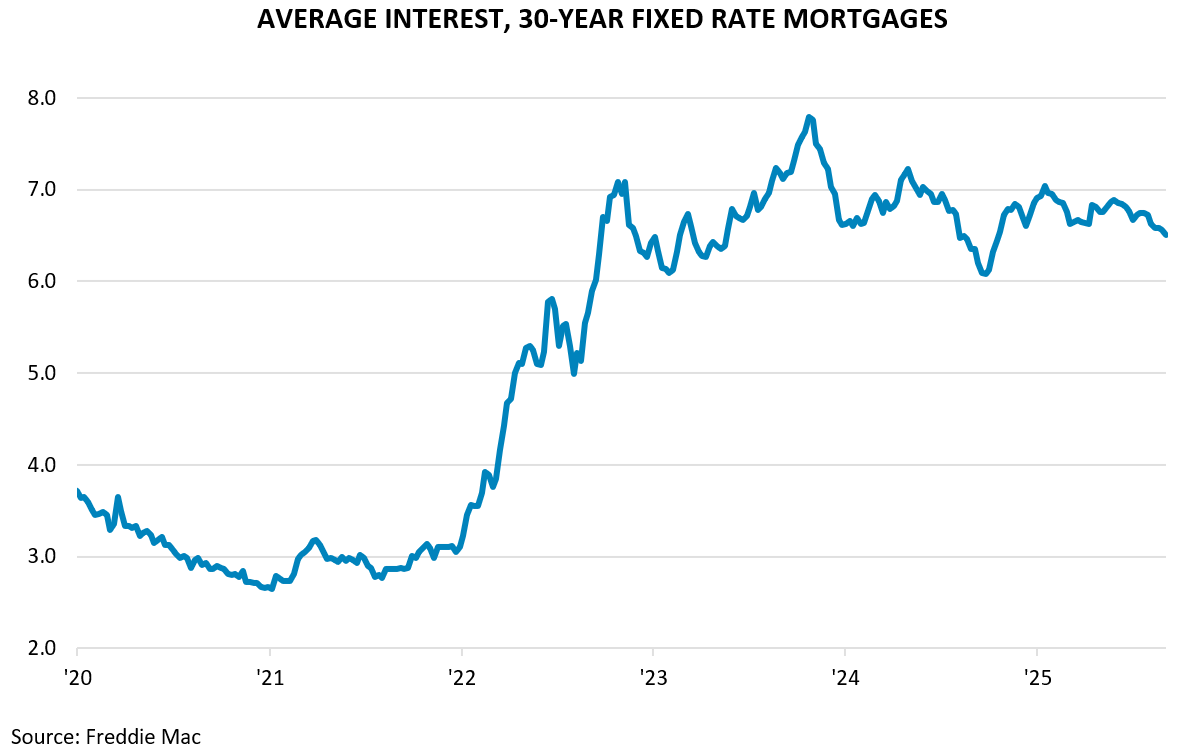

Mortgage rates have continued to drop since the beginning of the summer, with the average 30-year fixed rate mortgage declining from 6.9 percent in the final week of May to 6.5 percent in the first week of September. This represents the lowest average level for mortgages since last October when they stood at 6.4 percent. This drop was driven by lower treasury yields in August along with slower job growth raising the odds that the Federal Reserve will cut interest rates.

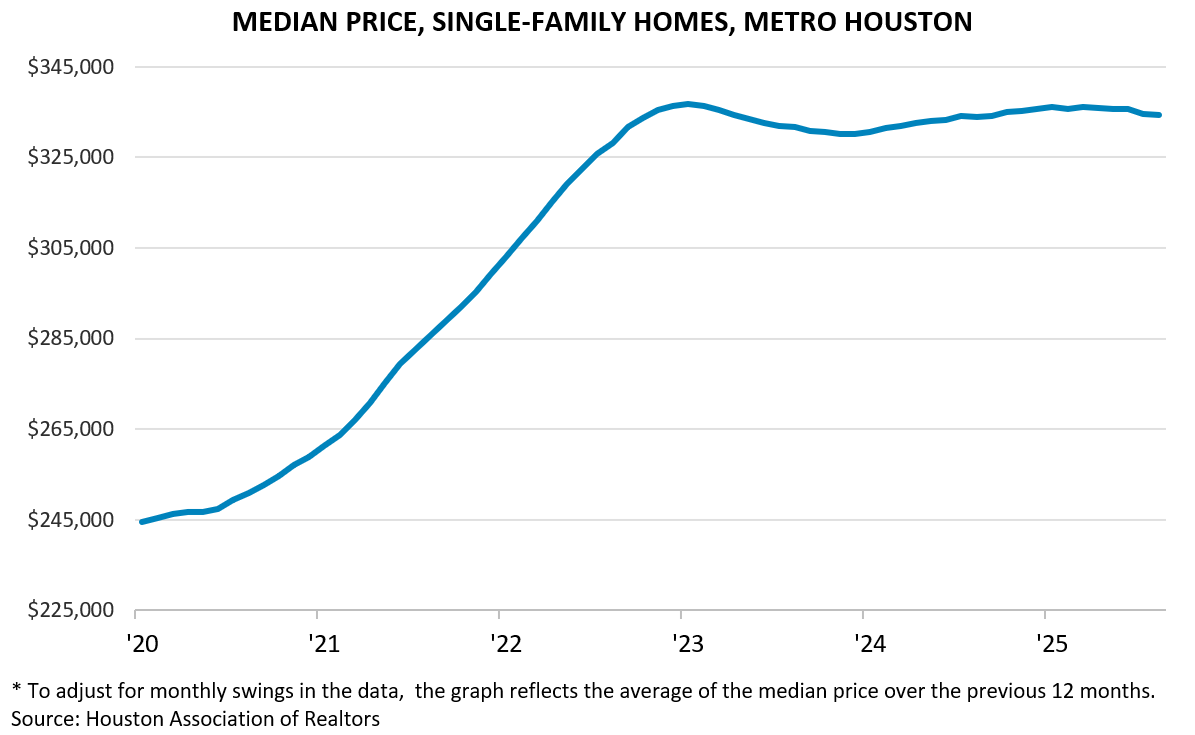

The price of homes sold through HAR’s Multiple Listing Service (MLS) shows signs of trending downwards. The 12-month average price for the median single-family, at roughly $334,000, was unchanged between August ’24 and ‘25. However, the price has been trending downward from January’s $336,000.

Demand for townhomes and condos has weakened, with 13.5 percent fewer sales year-over-year accompanied by lower prices and growing inventories. Highrise units saw flat sales, growing prices, and a 9.4 percent increase in active listings.

Prepared by Greater Houston Partnership Research

Colin Baker

Manager of Economic Research

Greater Houston Partnership

[email protected]