One Houston Together: Member Spotlight on JPMorgan Chase's $30B Commitment to Racial Equity

Published May 09, 2022 by A.J. Mistretta

As part of its ongoing effort to showcase success in supplier diversity, the Partnership’s One Houston Together initiative hosted its latest roundtable discussion in late April featuring a case study with financial services firm JPMorgan Chase & Co.

Supplier diversity is one of the two priorities of One Houston Together alongside talent advancement and board representation. The roundtable discussions are designed to showcase Partnership members that are leading change and to share best practices.

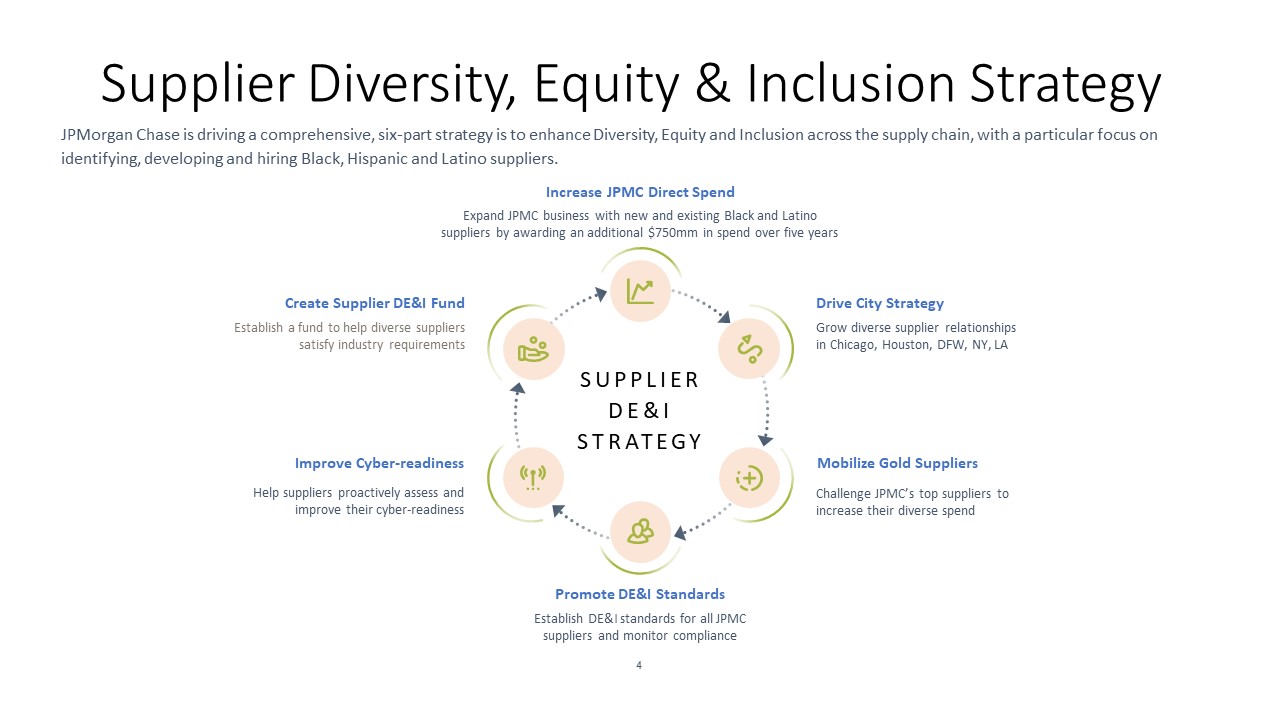

In 2020, JPMorgan Chase committed $30 billion over a five-year period to advance racial equity. The firm said at the time that it would harness its expertise in business, policy and philanthropy to address the key drivers of the racial wealth divide, reduce systemic racism against Black and Latinx people, and support employees. Part of the bank’s commitment includes $750 million in additional spending with Black and Latinx suppliers.

JPMorgan partners with its sourcing managers and business units to ensure supplier diversity throughout the sourcing process. Qualified and certified minority business enterprises (MBEs) are identified from the bank’s diverse supplier registration portal and external supplier databases to source vendors that can meet business needs.

Jim Flynn, Executive Director of Global Supplier Diversity at JPMorgan, joined the roundtable and discussed the bank’s diverse supplier program and how it’s grown in recent years. Since 2015, JPMorgan has spent $11 billion with diverse suppliers.

In 2020, the bank examined how they could become more activist and intentional in their approach while leveraging their own supply chain to expand the reach to more MBEs. Today, he said, the company is much more focused on business development and a holistic supply chain centered approach.

“The old model was meeting companies where they are,” Flynn said. “Our new approach goes beyond that to how do we increase overall inclusivity by working with our suppliers and helping them develop a program with specific standards.”

JPMorgan’s robust Tier 2 Program, aimed at encouraging its direct or prime vendors to use MBEs, puts those prime vendors into three categories: nascent, emerging and mature. The bank works with its suppliers in each category to help them develop an effective supplier diversity program of their own. The company also requests its suppliers to report their diverse supplier spend on a quarterly basis.

“We’re asking our primes to be interested in what we’re doing and to be engaged,” Flynn said. “We’re sharing our success stories with MBEs with them because sometimes the MBEs core competencies may be best suited to one of our suppliers. So we’ve gotten better at showcasing the MBEs to the group.”

Through their city strategy/focus, “We have an opportunity in Houston to leverage the power of partnership to do this work,” Flynn said.

Flynn said when it comes to MBE supplier success, JPMorgan is focused on finding, protecting and propelling effective MBEs in their network.

Learn more about One Houston Together and the Equity & Inclusion Assessment.

The Houston Report

The Houston Report